- Volume 2 (2019), Issue 2

- Vol. 2 (2019), No. 2

- >

- Pages 87 - 94

- pp. 87 - 94

- Back

Understanding ‘AI Made in Germany’::

A Report on the German Startup Landscape

I. Introduction

In 2018, the German Federal Government released a dedicated strategy to support ‘Artificial Intelligence (AI) made in Germany.’1 Underlying the strategy is the aim to fuel productivity in the German economy, where 65% of jobs could be automated using AI technology, with the potential to increase productivity and ultimately GDP growth.2 Another important aim is to develop AI-based business models ‘made in Germany’ that can shape the way AI is used across industries at a global scale.3

Startups play an important role in achieving both aims, as they not only develop AI technologies, products and services but also novel technology-based business models. Estimates suggest that about 60% of GDP growth from AI technology could be driven by new business models, while the remaining 40% could result from automation and transformation of existing business models through AI technologies.4 With policymakers, investors, incumbents and entrepreneurs taking increasing interest in novel AI business models, it becomes more and more important to understand what ‘AI made in Germany’ actually looks like. Several descriptive studies have evaluated the German AI landscape,5 some with a particular focus on startups.6 However, academic publications have so far focused on the impact of digital technologies (such as AI) in specific industries7 and on business model innovation in general.8

By contrast, little attention has been paid to specific business models of German AI startups, in particular the types of AI technologies employed and the value propositions developed. This report thus aims to answer the following questions: (1) What types of AI technology do German AI startups develop? (2) What are the value propositions they offer to the market? (3) How do German AI startups design their business models?

To answer these questions, we employ a mixed method approach. Firstly, we analyse a comprehensive database of German startups to answer questions 1 and 2. Through this analysis, we identify in particular the scope of German AI startups’ value proposition within existing sectors. Here we derive three types of value propositions that German AI startups focus on. Secondly, we illustrate each type of value proposition with an example of a German AI startup, showing how they design their business model around AI technology.

With these findings, we aim to provide a basis for decision makers in business and politics to understand the potential impact of AI ‘made in Germany’ on value creation and productivity. Additionally, we contribute to current research on business models which aims to understand how business models emerge and how the underlying value architecture is designed.9

II. Artificial Intelligence

The term ‘Artificial Intelligence’ dates back as far as the 1950s, when computer scientists first proclaimed that machines could someday talk, solve problems and perform creative tasks – activities so far exclusively done by humans.10 In this sense, the distinction between weak and strong AI is important – weak AI is limited to performing specific predefined tasks that support human intelligence, while strong AI tries to replicate broad cognitive tasks and mimic human behaviour.11 The present study is concerned with weak AI, since the commercialisation of strong AI may still be many years away.

AI has gained wider significance thanks to the rapid development of internet and communication technologies since the early 2000s. In particular the availability of large datasets and more powerful computers fuelled the emergence of novel AI technologies, in particular machine learning.12 Machine learning can be considered the key technology behind AI. Machine learning entails the structuring and analysis of large amounts of input data using statistical learning methods and algorithms to derive highly accurate predictions of outputs. Neural networks and deep learning as well as access to large training datasets have increased the performance of machine learning algorithms to nearly match human predictions in some areas of cognition.13 Other technologies associated with AI are data analytics, image and video recognition, text and speech processing as well as sensor technologies and robotics. All of these technologies involve non-human entities (machines, computers, robots, etc.) that recognise, label, and analyse various input data. While data analytics, image, video, text and speech recognition mostly map previously digitised digital datasets, sensors enable the recording and processing of environmental data, and robotic systems employ machine learning to act and react in predictable physical environments.14

Its unique technical features make machine learning applicable across virtually any industry and application area. Scholars tend to agree that it is a so-called general purpose technology (GPT)15 – meaning that it is pervasive, continuously improving over time, and stimulating of complementary innovation.16 Machine learning as a GPT can drive change on three different levels – tasks, business processes and business models.17

Accordingly, AI can offer different value propositions. Firstly, AI can augment and automate existing tasks and processes to significantly reduce costs. Secondly, AI can change the way firms innovate18 by enabling new forms of insight from large sets of data that were previously unavailable. And lastly, AI can stimulate entirely new avenues for value creation.19

While the economic potential of machine learning has been widely discussed, its full potential has not been tapped yet. Startups play a central role in unlocking this potential by identifying new realms of technological innovation and application, and driving the implementation of solutions across industries.20

III. Business Model Design

A business model is an abstracted but holistic representation of how a firm does business. It describes the way a firm creates and delivers value to its customers, and how it captures a share of the created value as profits.21 Each firm uses a uniquely configured architecture of activities to create, deliver and capture value, which makes up the essence of its business model.22 Business models have been studied widely in the context of new ventures,23 for instance, as a means to commercialise new technologies24 and disrupt entire industries.25

The question of business model design, or how business models emerge by deliberate actions of managers and entrepreneurs, is of central importance.26 Recent studies have looked conceptually at how value architectures are designed,27 proposing different tools to be used in the business model design process28. One of the most widely used tools to describe business model design by both practitioners and academics is the Business Model Canvas (BMC).29 The BMC splits the business model into nine categories that detail specific activities to create, deliver and capture value and thus describes the underlying value architecture.

Firms create value by defining a clear value proposition and identifying and implementing the key activities needed to deliver on that promise. Companies source the required resources and build relationships with partners to ensure smooth production of the product or service. They deliver value by defining customer segments and understanding their specific needs. From this understanding, the company builds communication and distribution channels to reach these customers. Companies monetise the value created by optimising their cost structure and defining revenue streams30.

1. Methodology

To answer our research questions, we employed a two-fold approach. First, we analysed a sample of 139 German AI startups based on the AppliedAI31 database in January 2019. The goal was to cluster the startups in the sample into meaningful categories of AI technologies and value propositions. At the time it was drawn, the sample represented a fairly comprehensive list of all German AI startups. One of the authors and a research assistant independently coded each startup based on information available on its website, Crunchbase and other publicly available information. To assign a startup to an AI technology, we used the categorisation proposed by Hecker and others:32 image and video recognition, text and speech processing, data analytics, sensors and robotics. To categorise value propositions, we used a literature-based distinction between (1) automation of tasks, (2) innovation processes and (3) novel forms of value creation. To finally analyse the underlying business model design processes, we interviewed three founders of AI startups. During the interview we collected information on all dimensions of the BMC.

2. Types of AI Technology

The German AI startup landscape consisted of 139 startups as of January 2019. 40% of firms had been founded within the last three years and 84% were in seed or early venture stages. The majority (65%) of all startups were located in the two German startup hubs, Berlin and Munich.

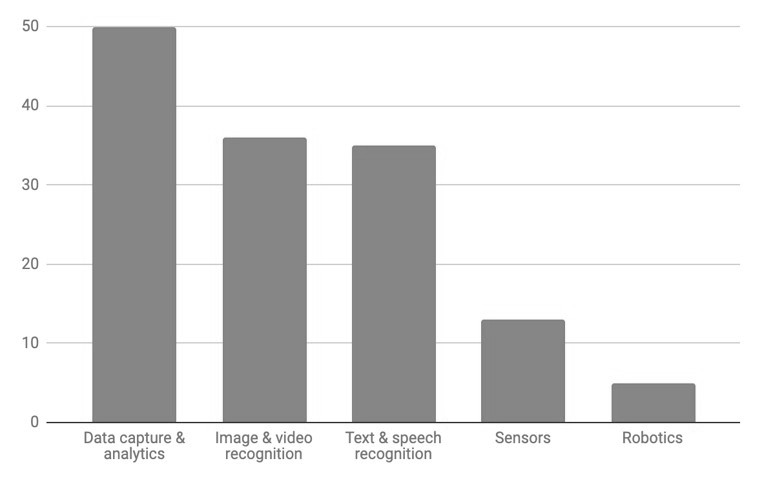

We found that all German AI startups employ some form of machine learning. However, they differ greatly in the complementary technologies used to establish a marketable product. 36% of all German AI startups focus on data capture and analytics in areas such as financial analysis, online marketing or business process optimisation. 26% use image and video recognition in various contexts from medical diagnostics to autonomous driving, while 25% develop AI solutions based on text and speech recognition, mainly to build AI for chatbots or customer service solutions. Only 9% focus on AI solutions connected to sensors while 4% work on advanced robotic solutions (see Figure 1).

3. Value Propositions

We found that 43% of German AI startups specialise on the development of technology which can be used as a means for product or process innovation by other firms. We call these AI startups ‘Technology Developers’. They offer highly advanced technology to help existing firms develop AI-based products, for example, one startup is developing a technology to create real-time 3D maps of a given physical environment. These maps are essential to help autonomous vehicles or robots navigate in this environment. Hence, firms that are working to develop autonomous vehicles and robots often rely on technology developers to supply 3D maps for training their vehicles and robots to navigate in a given environment.

Some also offer advanced technology to allow firms to innovate their business processes, for example, another German startup develops advanced image recognition technology that can be used to capture and analyse documents. Currently, this task involves a lot of manual work which can be automated and integrated into innovative processes with the AI-based technology. The AI technology offered by Technology Developers is highly advanced and specialised, but it can be applied across a range of industries and sectors.

28% of AI startups develop technology that helps to automate existing tasks or processes – they are ‘Business Transformers’. Especially in sectors where a lot of structured data is already available, AI-based solutions can increase productivity significantly. Some of the most common application areas include customer service, marketing and human relations. Business Transformers often use speech and text recognition to automate existing processes, for example through customer service chatbots that can answer commonly asked questions very quickly. Data analytics is commonly used to optimise online marketing campaigns across different platforms, particularly in e-commerce. Since business processes can be similar across industries, many of the Business Transformer startups work across at least a few sectors.

29% of startups create entirely new modes of value creation, generating consumer-facing products or solutions – we refer to these as ‘Solution Providers’. While the value propositions of Technology Developers and Business Transformers have to be integrated with existing value creation processes, Solution Providers develop industry-specific solutions that not only change the way business is done currently but create entirely new products. For example, Solution Providers develop health assistants that can give individualised information and advice about tracked health parameters, or they produce robotic solutions for logistics environments like warehouses. Table 1 provides an overview of value propositions.

4. Business Model Design

To illustrate how startups arrive at the three value propositions we identified, we interviewed founders about how they designed their business models. The purposes of the case studies were exploration and illustration; we thus interviewed only one founder per type of value proposition.

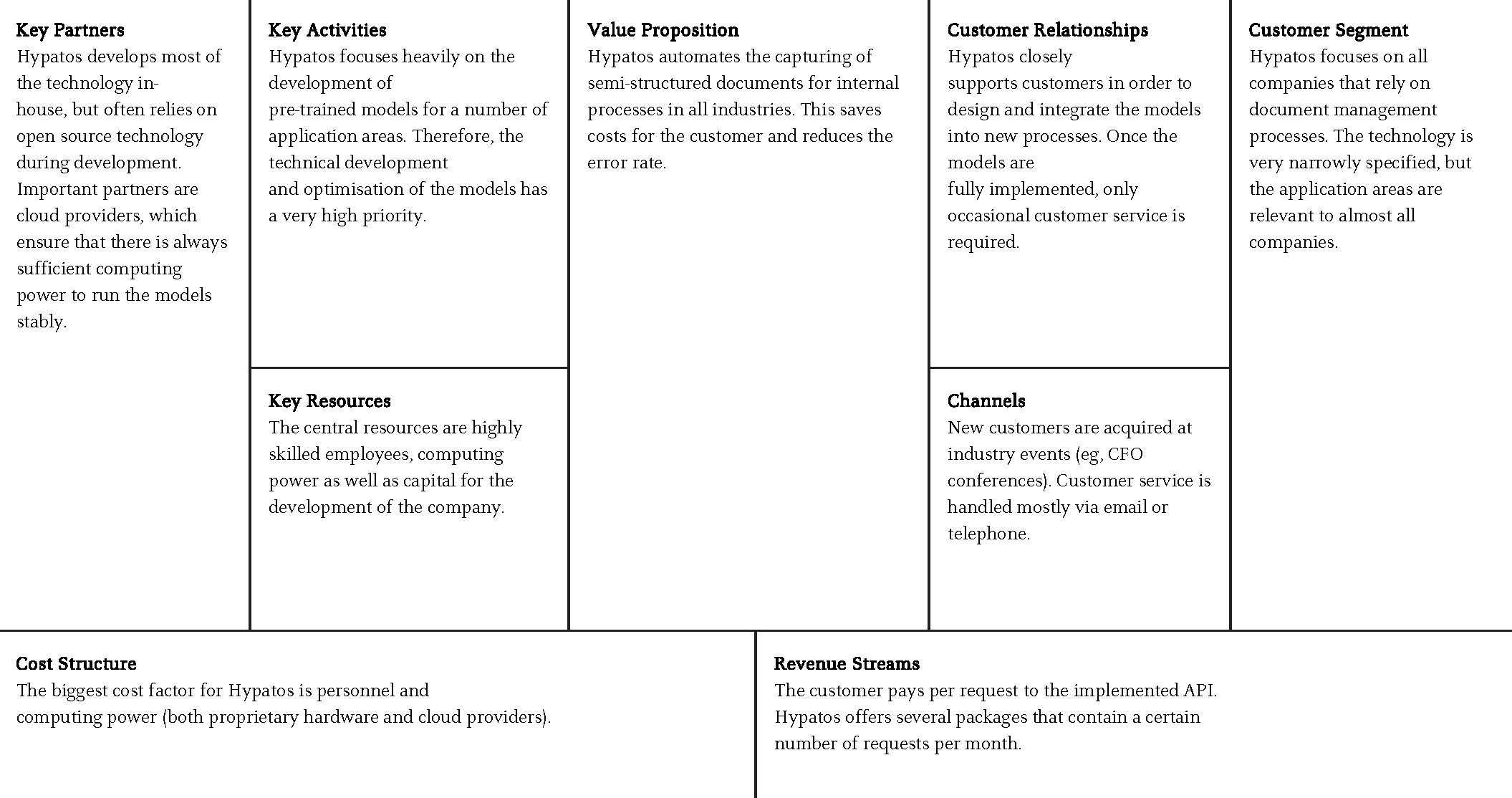

a. Technology Developer: Hypatos

Founded 2018 in Berlin, Hypatos develops advanced image recognition technologies and neural networks. In particular, it focuses on automated capturing and classification of semi-structured documents, such as invoices, payslips or prescriptions, to reduce the manual effort required to capture such documents. The startup offers two products: pre-trained solutions for more standardised applications and a studio software where customers can design and train specialised solutions. Table 2 shows the BMC for Hypatos.

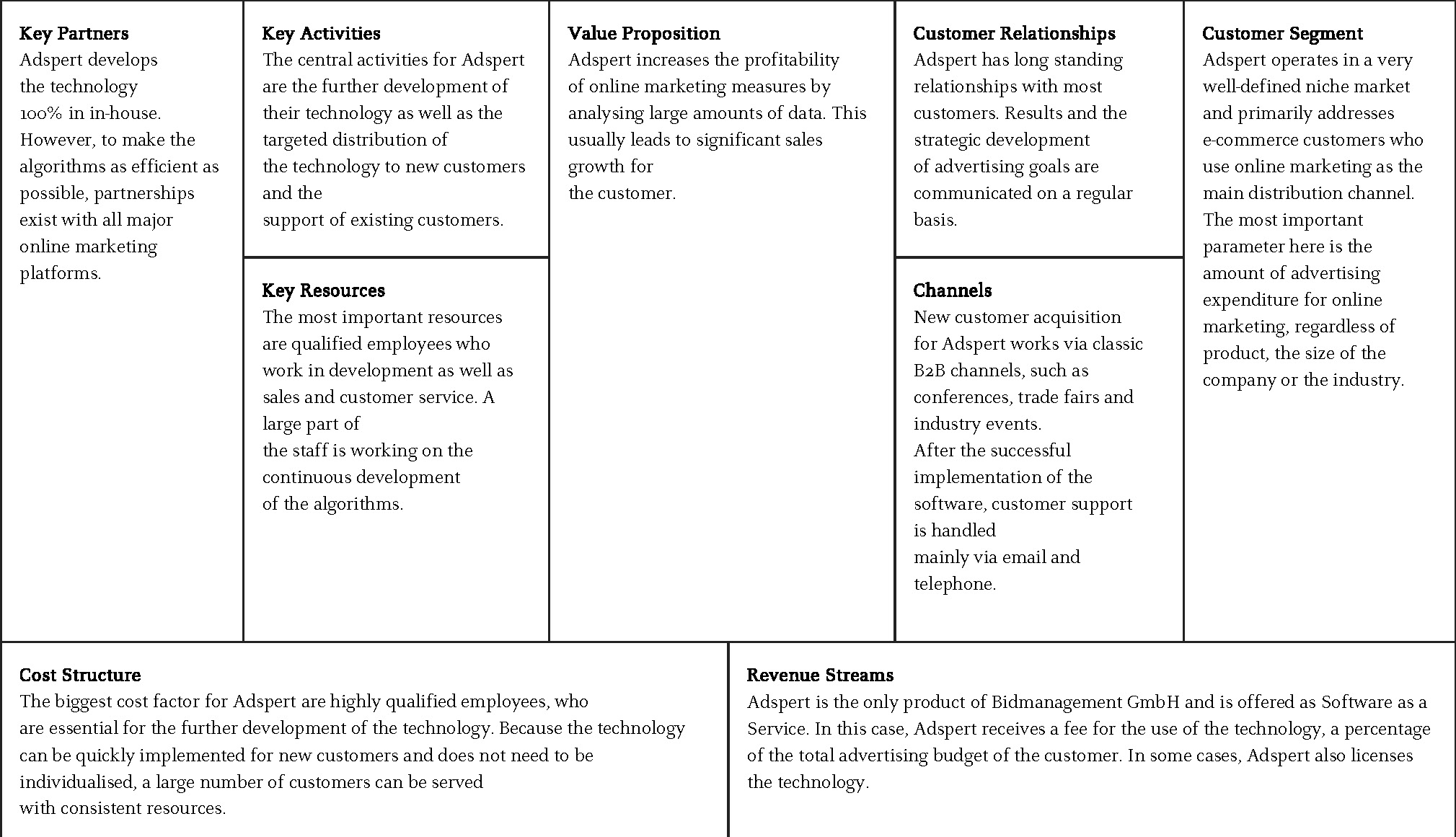

b. Business Transformer: Adspert

Adspert is a product of the Berlin-based Bidmanagement GmbH, founded in 2010. Adspert uses advanced statistical models from the financial trading industry to optimise keywords and bids for online marketing campaigns on different platforms. The foundational statistical models have remained similar since the company was founded, but large amounts of available data (eg from ecommerce platforms) and increased computing power have boosted their predictive capabilities. Through the automation of the time and labour-intensive process of optimising keywords and bids, Adspert promises to increase profits for its customers through increased conversions. Table 3 shows the Adspert’s BCM.

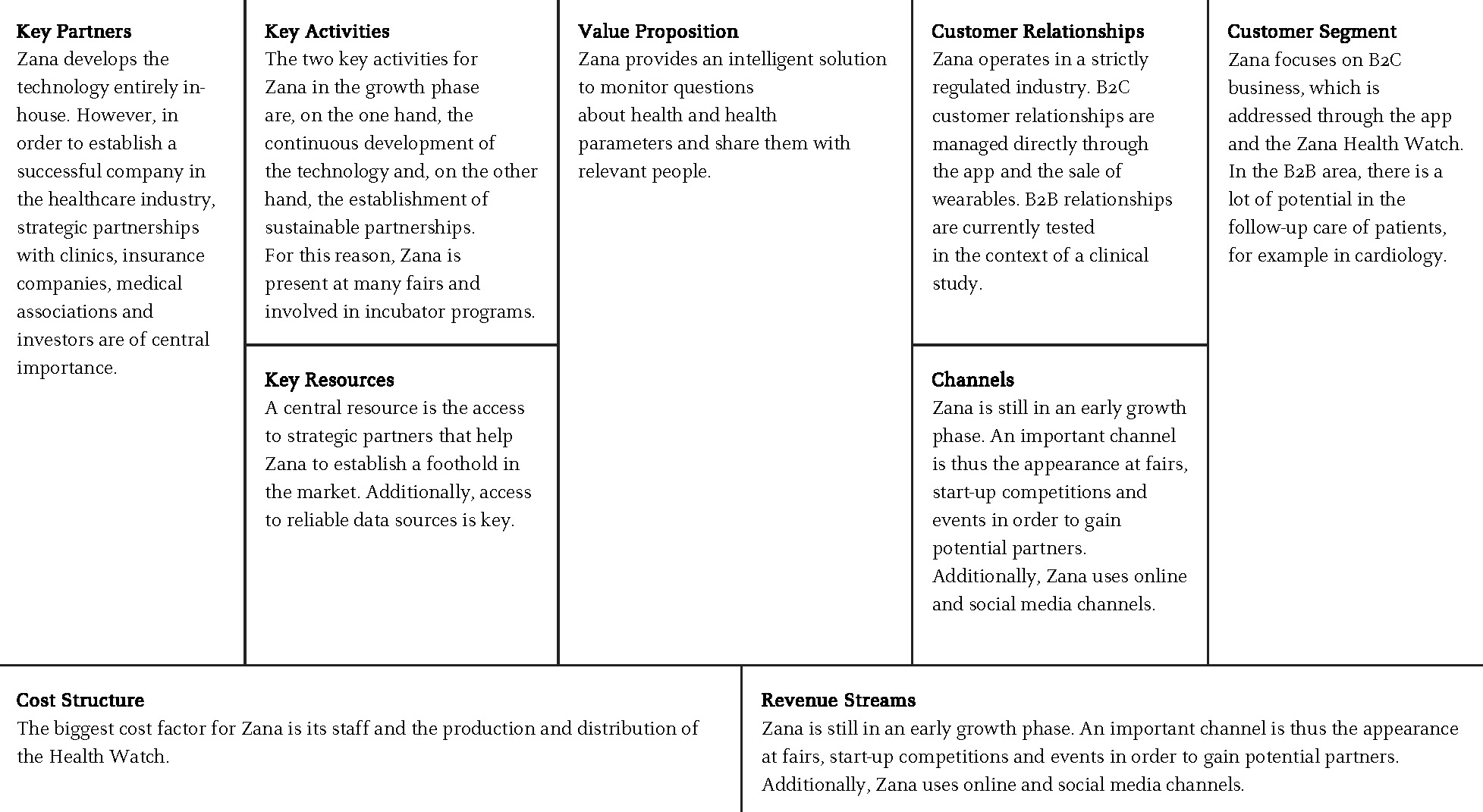

c. Solution Provider: Zana

Zana was founded 2018 in Karlsruhe. The firm is developing an AI-based virtual assistant that can guide users with health-related questions and allowing the user to track health parameters through wearables. A special feature is the Remote Monitoring Platform allows family members to check in on a relative’s health statistics, for example, for elderly or chronically ill persons. The data from the platform can also be aggregated and shared with doctors or health care providers to ensure the effective monitoring of patients in critical states, for instance, after major surgeries that require close aftercare. Table 4 shows the BMC for Zana.

V. Discussion

Our findings hold some valuable insights for both academics and decision makers seeking to understand ‘AI made in Germany’. Although Germany’s AI startup landscape produces a variety of novel AI technologies and business models, it is apparent that startups largely focus on AI technologies like data capture & analysis, which allow for in-depth analysis of large digital datasets to derive conclusions and potential recommendations for action. So far, startups have focused less on technologies like sensors and robotics that not only work with digital datasets but also engage with environmental data. Given that the startup ecosystem is still very young, this trend is not surprising: environmental data is hard to acquire and structure, and it presents additional challenges in terms of data privacy and security.

When examining value propositions that German AI startups provide, we identified three types: Technology Providers, Business Transformers, and Solution Providers. These categories are in line with current research on the role of AI as a GPT and also mirror our findings on technology types. Technology Providers and Business Transformers focus largely on areas where existing data and processes can be leveraged, typically within existing firms in sectors where data is easily accessible and structured. We conclude, that both Technology Providers and Business Transformers play an essential role in making Germany a leading AI nation because they extend AI technologies deep into existing value creation and innovation processes.

However, both these value propositions focus on the transformation of existing business through automation, leading to cost reductions and productivity increases, but not a fundamental change in the product portfolio that is available to end customers33. To fully tap into the innovative potential of ‘AI made in Germany’, Solution Providers must play an even bigger role. They do not only change the way business is currently done but create entirely new areas of business. Yet, these AI startups face a different competitive setup: they may struggle to establish a functioning business in established industries where strong incumbents define the rules of the game, where data may not be as readily available and where regulation may prevent easy market access.34

Looking at the underlying business models for these three value propositions, we conclude that value creation and delivery are of particular importance for Technology Providers and Business Transformers, in particular access to highly skilled talent, computing power and structured sales cycles. In turn, for value capture, these startups often rely on proven revenue models.35 In contrast, Solution Providers’ business model design relies less on proven models and instead involves much more experimentation. Aside from access to talent, partnerships and access to data become essential factors to guarantee value creation and delivery. Solution Providers capture value by experimenting with different revenue models to finally design the most effective one. The difference in value architectures reflects the challenges that Solution Providers face.

To summarise, we see a lot of potential in the German AI startup landscape, which continues to grow exponentially. At the time of publication of this paper, Applied AI counted 214 startups - a stunning 54% increase in merely six months. However, despite the landscape’s dynamism, it must be stated that the full potential of AI technologies has yet to be uncovered. Technology Developers and Business Transformers are an important starting point to transform the existing economic system and realise productivity gains through automation. Still, Solution Providers may be even more important in order to establish an ‘AI made in Germany’ that generates novel technologies that are commercialised through sustainable business models and are competitive at global scale.

To this end, startups ought to find an infrastructure enabling them to deliver new business models, even when those have the potential to disrupt established industries. Strategic partnerships between startups and incumbents as well as regulators are key to ensure a development of these new business models. Another key component is to guarantee access to data while ensuring data protection and privacy. With these enablers, ‘AI made in Germany’ has the potential to fuel productivity and economic growth through the transformation of existing industries and the creation of entirely new industries, driven by novel AI-based business models.

Table1

Table1

Notes

[1] Deutschland Bundesregierung, ‘Strategie Künstliche Intelligenz’ (Bundesministerium für Bildung und Forschung, November 2018) <https://www.bmbf.de/files/Nationale_KI-Strategie.pdf> accessed 10 June 2019

[2] Christian Kirschniak, ‘Auswirkung Der Nutzung von Künstlicher Intelligenz in Deutschland’ (PwC Germany GmbH, Juni 2018) <https://www.pwc.de/de/business-analytics/sizing-the-price-final-juni-2018.pdf> accessed 10 June 2019

[5] Dirk Hecker and others, ‘Zukunftsmarkt Künstliche Intelligenz - Potentiale Und Anwendungen’ (Fraunhofer, 2017) <https://www.bigdata.fraunhofer.de/content/dam/bigdata/de/documents/Publikationen/KI-Potenzialanalyse_2017.pdf> accessed 10 June 2019; Inga Döbel and others, ‘Maschinelles Lernen - Eine Analyse Zu Kompetenzen, Forschung, Und Anwendung’ (Fraunhofer, 2018) <https://www.bigdata.fraunhofer.de/content/dam/bigdata/de/documents/Publikationen/Fraunhofer_Studie_ML_201809.pdf> accessed 10 June 2019

[6] Axelle Lemaire and others, ‘Artificial Intelligence – A Strategy for European Startups Recommendations for Policymakers’ (Roland Berger GmbH, 2018) <https://www.rolandberger.com/en/Media/AI-startups-as-innovations-drivers-Europe-must-take-action-to-establish-a-compe.html> accessed 10 June 2019

[7] Daniel Kiel, Christian Arnold and Kai-Ingo Voigt, ‘The Influence of the Industrial Internet of Things on Business Models of Established Manufacturing Companies – A Business Level Perspective’ (2017) 68 Technovation 4; Ke Rong, Dean Patton and Weiwei Chen, ‘Business Models Dynamics and Business Ecosystems in the Emerging 3D Printing Industry’ (2018) 134 Technological Forecasting and Social Change 234; Jahangir Karimi and Zhiping Walter, ‘Corporate Entrepreneurship, Disruptive Business Model Innovation Adoption, and Its Performance: The Case of the Newspaper Industry’ (2016) 49 Long Range Planning 342

[8] Christoph Zott and Raphael Amit, ‘Business Model Design: An Activity System Perspective’ (2010) 43 Long Range Planning 216; Henry Chesbrough and R Rosenbloom, ‘The Role of the Business Model in Capturing Value from Innovation: Evidence from Xerox Corporation’s Technology Spin-off Companies’ (2002) 11 Industrial and Corporate Change 529

[9] Nicolai J Foss and Tina Saebi, ‘Business Models and Business Model Innovation: Between Wicked and Paradigmatic Problems’ (2018) 51 Long Range Planning 9; Lorenzo Massa, Christopher Tucci and Allan Afuah, ‘A Critical Assessment of Business Model Research’ (2017) 11 Academy of Management Annals 73; Marikka Heikkilä, Harry Bouwman and Jukka Heikkilä, ‘From Strategic Goals to Business Model Innovation Paths: An Exploratory Study’ (2017) 25 Journal of Small Business and Enterprise Development 107; Antonio Ghezzi and Angelo Cavallo, ‘Agile Business Model Innovation in Digital Entrepreneurship: Lean Startup Approaches’ (2018) Journal of Business Research, in press

[11] Inga Döbel and others (n 5); Erik Brynjolfsson, Daniel Rock and Chad Syverson, ‘Artificial Intelligence and the Modern Productivity Paradox: A Clash of Expectations and Statistics’ (National Bureau of Economic Research, 2017) 24001 Working Paper Series <http://www.nber.org/papers/w24001.pdf> accessed 10 June 2019; Ajay Agrawal, Gans Joshua and Goldfarb Avi (eds), The Economics of Artificial Intelligence: An Agenda (University of Chicago Press 2019) <https://www.press.uchicago.edu/ucp/books/book/chicago/E/bo35780726.html> accessed 27 May 2019

[14] Hecker and others (n 5); Erik Brynjolfsson and Andrew Mcafee, ‘The Business of Artificial Intelligence’ [2017] Harvard Business Review

[15] Brynjolfsson, Rock and Syverson (n 11); Agrawal, Joshua and Avi (n 11); Iain Cockburn, Rebecca Henderson and Scott Stern, ‘The Impact of Artificial Intelligence on Innovation’ (National Bureau of Economic Research, 2018) 24449 Working Paper Series <http://www.nber.org/papers/w24449.pdf> accessed 10 June 2019

[16] Timothy F Bresnahan and M Trajtenberg, ‘General Purpose Technologies `Engines of Growth’?’ (1995) 65 Journal of Economics 83

[18] Cockburn, Henderson and Stern (n 15); Philippe Aghion, Benjamin Jones and Charles Jones, ‘Artificial Intelligence and Economic Growth’ (National Bureau of Economic Research, 2017) w23928 Working Paper Series <http://www.nber.org/papers/w23928.pdf> accessed 10 June 2019

[20] Aghion, Jones and Jones (n 18); Cockburn, Henderson and Stern (n 15); Agrawal, Joshua and Avi (n 11)

[21] David J Teece, ‘Business Models, Business Strategy and Innovation’ (2010) 43 Long Range Plann 172

[23] Raphael Amit and Christoph Zott, ‘Value Creation in E-Business’ (2001) 22 Strategic Manage. J. 493; Charles Baden-Fuller and Stefan Haefliger, ‘Business Models and Technological Innovation’ (2013) 46 Long Range Planning 419; Teece (n 21); Raphael Amit and Xu Han, ‘Value Creation through Novel Resource Configurations in a Digitally Enabled World’ (2017) 11 Strategic Entrepreneurship Journal 228

[24] David J Teece, ‘Profiting from Innovation in the Digital Economy: Enabling Technologies, Standards, and Licensing Models in the Wireless World’ (2018) 47 Research Policy 1367; Chesbrough and Rosenbloom (n 8); Marc König and others, ‘Different Patterns in the Evolution of Digital and Non-Digital Ventures’ Business Models’ (2018) Technological Forecasting and Social Change in press

[25] Daniel Trabucchi, Luca Talenti and Tommaso Buganza, ‘How Do Big Bang Disruptors Look like? A Business Model Perspective’ (2019) 141 Technological Forecasting and Social Change 330; Karimi and Walter (n 7); Teece (n 24)

[28] Ghezzi and Cavallo (n 9); Heikkilä, Bouwman and Heikkilä (n 9); Concetta Metallo and others, ‘Understanding Business Model in the Internet of Things Industry’ (2018) 136 Technological Forecasting and Social Change 298; Trabucchi, Talenti and Buganza (n 25)

[29] Alexander Osterwalder, Yves Pigneur and Tim Clark, Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers (Wiley 2010)